Mar 27, 2024

The Ultimate Guide to Bank Reconciliation

- Bank reconciliation is the vital process of aligning your company's financial records with your bank's, ensuring accuracy and identifying any discrepancies.

- Its significance lies in error detection, fraud prevention, and maintaining reliable financial reports, benefiting businesses of all sizes.

- Implementing best practices like regular reconciliation, meticulous record-keeping, and leveraging automation tools can streamline the process, saving time and enhancing accuracy in financial management.

Table of Contents

- Definition of Bank Reconciliation

- Purpose of Bank Reconciliation

- Importance of Bank Reconciliation for Businesses

- Steps to Perform a Bank Reconciliation

- Best Practices for Bank Reconciliation

- Common Challenges in Bank Reconciliation and How to Overcome Them

- Tools and Software for Bank Reconciliation

- Benefits of Automating the Bank Reconciliation Processes

- Conclusion: The Importance of Regular and Accurate Bank Reconciliation

Do you ever find yourself puzzled by the discrepancies between your bank statement and your company's records?

If so, you're not alone. Bank reconciliation is an important financial process that can help you solve this mystery. In this article, you will get an introduction to bank reconciliation, providing you with a clear definition, outlining its purpose, and sharing some best practices to optimize this important task.

Bank reconciliation is the process of comparing your company's financial records with the information provided by your bank. The goal is to identify and resolve any discrepancies between the two sets of data, ensuring that your records accurately reflect your financial position.

By undertaking regular bank reconciliations, you can prevent errors and fraud, detect unauthorized transactions, and ensure the accuracy of your financial reports. Whether you're a business owner, accountant, or someone simply interested in understanding financial processes, this article will equip you with the knowledge and best practices to effectively carry out bank reconciliations.

Get ready to learn how to streamline this important task, minimize errors, and maintain the financial health of your business.

Definition of Bank Reconciliation

Bank reconciliation is the process of comparing your company's financial records with the information provided by your bank. The goal is to identify and resolve any discrepancies between the two sets of data, ensuring that your records accurately reflect your financial position.

It involves matching the transactions recorded in your company's books with the transactions recorded by the bank. This includes comparing the balances, deposits, withdrawals, and any other relevant financial activities. The process helps you identify errors, omissions, and fraudulent activities, ensuring that your financial records are accurate and up to date.

Purpose of Bank Reconciliation

The purpose of bank reconciliation is multi-fold. Firstly, it helps you identify and rectify errors in your financial records. This could include incorrect data entry, missing transactions, or discrepancies caused by timing differences. By regularly reconciling your bank accounts, you can catch these errors early on, preventing them from causing larger issues down the line.

Secondly, it is crucial for detecting unauthorized transactions. In today's digital age, fraud and cybercrime are significant concerns for businesses. By comparing your records with the bank's, you can quickly identify any unauthorized withdrawals or suspicious activities, allowing you to take immediate action.

Lastly, it ensures the accuracy of your financial reports. Reliable financial information is essential for making informed business decisions, complying with regulatory requirements, and building trust with stakeholders. By regularly reconciling your bank accounts, you can have confidence in the accuracy of your financial reports.

Importance of Bank Reconciliation for Businesses

Bank reconciliation is particularly important for businesses of all sizes. It provides several benefits that contribute to the overall financial health and success of the organization.

First and foremost, accurate bank reconciliation helps businesses maintain control over their finances. By comparing the bank's records with their own, businesses can identify discrepancies and take appropriate actions, helping prevent financial losses due to errors, fraud, or unauthorized transactions.

Additionally, it ensures compliance with accounting standards and regulations. Financial reporting standards require businesses to accurately record and report their financial activities, and by conducting regular bank reconciliations, businesses can ensure compliance and avoid penalties or legal issues.

Furthermore, it provides valuable insights into cash flow management. By understanding the timing and nature of transactions, businesses can optimize their cash flow and make informed decisions about budgeting, planning, and forecasting.

Steps to Perform a Bank Reconciliation

Performing a bank reconciliation involves several steps:

Start by collecting all relevant records, including bank statements, checkbooks, deposit slips, and any other documents or software that tracks financial transactions.

Compare the bank statement with your company's records, noting any differences in balances, deposits, or withdrawals.

Identify any outstanding checks or deposits that have not yet cleared the bank. These are transactions that you have recorded but have not yet been processed by the bank.

Adjust your company's records to reflect these outstanding transactions. This may involve adding or subtracting amounts from your balances.

Check for any errors, such as data entry mistakes or missing transactions. Reconcile these errors by making the necessary adjustments to your records.

Once all discrepancies have been resolved, ensure that your balances match, indicating a successful bank reconciliation.

Best Practices for Bank Reconciliation

To optimize the bank reconciliation process, consider the following best practices:

Perform bank reconciliations on a regular basis, ideally monthly or quarterly, depending on the volume of transactions and the size of your business.

Keep detailed and organized records of all financial transactions. This will make the reconciliation process more efficient and accurate.

Use accounting software or tools specifically designed for bank reconciliation. These tools can automate certain tasks, reduce errors, and provide real-time insights into your financial position.

Separate duties between employees involved in the bank reconciliation process. This helps prevent fraud or errors caused by a single individual having complete control over the process.

Conduct regular audits and reviews of your bank reconciliation process to ensure its effectiveness and identify areas for improvement.

Common Challenges in Bank Reconciliation and How to Overcome Them

While bank reconciliation is an essential process, it can come with its fair share of challenges. Some common challenges include:

Timing differences: Transactions may appear on your bank statement on a different date than when they were recorded in your books. To overcome this challenge, ensure that you account for timing differences when comparing records.

Bank fees and charges: Banks may deduct fees or charges that are not immediately reflected in your records. It's important to regularly review your bank statements and account for these fees during the reconciliation process.

Missing or incorrect information: Sometimes, transactions may be missing from your bank statement or recorded incorrectly. In such cases, reach out to your bank for clarification and make the necessary adjustments in your records.

Data entry errors: Mistakes happen, and data entry errors can occur during the reconciliation process. To minimize these errors, double-check your entries and consider using automation tools to reduce manual data entry.

Lack of documentation: Insufficient or missing documentation can make the reconciliation process more challenging. Ensure that you have proper documentation for all transactions and maintain organized records.

By being aware of these challenges and implementing strategies to overcome them, you can streamline the bank reconciliation process and ensure its accuracy.

Tools and Software for Bank Reconciliation

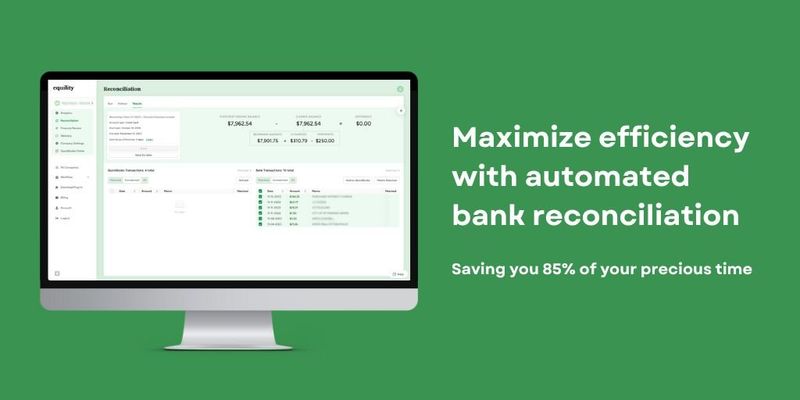

Several tools and software options are available to help streamline and automate the bank reconciliation process. These tools can reduce manual tasks, improve accuracy, and provide real-time insights into your financial position.

1. Accounting software: Many accounting software solutions like Quickbooks offer built-in bank reconciliation features. While these tools allow you to import bank statements, match transactions, and generate reconciliation reports, the process can still be time-consuming if there are hundreds of transactions to reconcile.

2. Bank feeds: Some banks provide direct integration with accounting software, allowing for automatic syncing of transactions. This eliminates the need for manual data entry and improves efficiency.

3. Reconciliation apps: There are various web applications specifically designed for bank reconciliation. These apps provide user-friendly interfaces, real-time updates, and customizable features to suit your business needs.

Some popular options include:

The choice of tools and software depends on your business requirements, budget, and personal preferences. Be sure to research and select the best option that aligns with your business’s needs.

Benefits of Automating the Bank Reconciliation Processes

Automating bank reconciliation processes offers several benefits for businesses:

Time and cost savings: Automation reduces manual tasks, saving time and minimizing the risk of errors. This allows employees to focus on more strategic and value-added activities.

Improved accuracy: Automation tools can match transactions with minimal errors, reducing the risk of human mistakes. This leads to more accurate financial records and reports.

Real-time insights: Automated bank reconciliation provides real-time updates on your financial position. This allows you to make informed decisions based on up-to-date information.

Enhanced security: Automation tools often come with built-in security features to protect sensitive financial data. This helps safeguard against fraud and unauthorized access.

Scalability: As your business grows, automation can easily accommodate increased transaction volumes without sacrificing accuracy or efficiency.

By embracing automation, businesses can streamline their bank reconciliation processes and reap the benefits of improved efficiency and accuracy.

Conclusion: The Importance of Regular and Accurate Bank Reconciliation

Bank reconciliation is a fundamental process for businesses to maintain control over their finances, detect fraudulent activities, and ensure the accuracy of financial reports.

By regularly reconciling your bank accounts, you can identify and rectify errors, comply with accounting standards, and make informed decisions based on reliable financial information. Implementing best practices, overcoming common challenges, and leveraging automation tools can streamline the bank reconciliation process, saving time and improving accuracy.

Don't underestimate the significance of bank reconciliation in financial management - it's an essential task that shouldn't be overlooked in your business practices. Start implementing these best practices today and enjoy the benefits of regular and accurate bank reconciliation.

Frequently Asked Questions

What is a bank reconciliation?

It is the process of comparing your company's financial records with the information provided by your bank.

Why should a bank reconciliation be prepared periodically?

By preparing bank reconciliations periodically, you can prevent errors and fraud, detect unauthorized transactions, and ensure the accuracy of your financial reports.

How to do a bank reconciliation?

Performing a bank reconciliation involves several steps:

Start by collecting all relevant records, including bank statements, checkbooks, deposit slips, and any other documents or software that tracks financial transactions.

Compare the bank statement with your company's records, noting any differences in balances, deposits, or withdrawals.

Identify any outstanding checks or deposits that have not yet cleared the bank. These are transactions that you have recorded but have not yet been processed by the bank.

Adjust your company's records to reflect these outstanding transactions. This may involve adding or subtracting amounts from your balances.

Check for any errors, such as data entry mistakes or missing transactions. Reconcile these errors by making the necessary adjustments to your records.

Once all discrepancies have been resolved, ensure that your balances match, indicating a successful bank reconciliation.

How to do a bank reconciliation in Quickbooks Online?

Access Reconciliation: Log in to your QuickBooks Online account and navigate to the Banking or Transactions tab.

Select Account: Choose the bank account you want to reconcile from the list of accounts.

Review Statement: Enter the ending date of the bank statement you're reconciling and the ending balance shown on the statement.

Match Transactions: QuickBooks will display a list of transactions from your bank statement and your QuickBooks records. Check off each transaction that appears on both the statement and in QuickBooks.

Enter Unmatched Transactions: If there are transactions on the bank statement that don't appear in QuickBooks or vice versa, enter them manually.

Reconcile: Once you've matched or entered all transactions, compare the ending balance in QuickBooks with the ending balance on the bank statement. If they match, you've successfully reconciled the account.

Review Discrepancies: If there are any discrepancies between the balances, review the transactions again to identify any errors or missing entries.

Adjustments: Make any necessary adjustments in QuickBooks to correct errors or missing entries.

Complete Reconciliation: Once the balances match and any discrepancies are resolved, complete the reconciliation process.

Review Reconciliation Report: QuickBooks will generate a reconciliation report summarizing the reconciliation process and any adjustments made. Review this report for accuracy and retain it for your records.

Repeat Regularly: Perform bank reconciliations regularly, ideally on a monthly basis, to ensure the accuracy of your financial records.

What is the primary purpose of a bank reconciliation?

The primary purpose is to identify and resolve any discrepancies between the two sets of data, ensuring that your records accurately reflect your financial position.

Share :

Michael Nieto

As the owner of the financial consulting firm, Lanyap Financial, Michael helped businesses and lending institutions who needed help improving their financial operations and identifying areas of financial weakness.

Michael has since leveraged this experience to found the software startup, Equility, which is focused on providing businesses with a real-time, unbiased assessment of their accounting accuracy, at a fraction of the cost of hiring an external auditor.

Connect with Michael on LinkedIn.

Related Blogs

See All BlogsOptimize Your Financial Processes

Streamline financial reviews and bank reconciliation with our platform. Gain actionable insights, automate workflows, and manage everything seamlessly in one place.